Home Loans Calculator

Get fast estimates with our home loans calculator. Get your home loan estimate now!

Easily Compare Rates Using a Home Loans Calculator

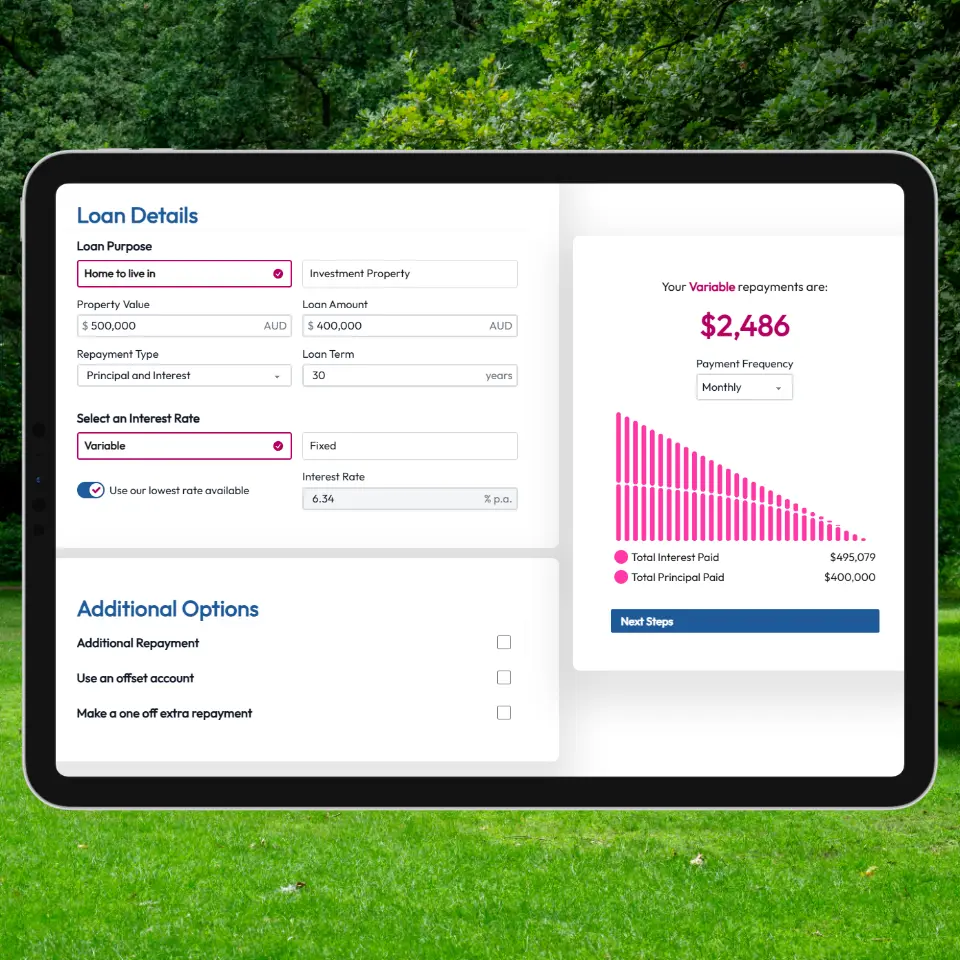

Finding the best interest rates in the large property lending market can be challenging and confusing. Our estimating device simplifies the process by enabling buyers to convert lender advertised rates into repayment estimates for their specific borrowing amount.

Suitable to generate estimates on all types of property finance, for both variable and fixed rate products, the device makes it easy to get the figures that buyers want to guide their decisions. Use our highly competitive rates to compare with other lenders and note how much we may save you in repayments each month. Rates vary with lenders and with individual applications.

Our experts are available to follow-up your estimates with rate quotes specific to your application and loan option.

We support property buyers to secure the most competitive market rates with our high-level expertise and our extensive lender connections. We have accreditations with over 80 lenders, which include the major banks and other lenders in both the banking and non-bank sectors. Ensure you secure the lending product and the best rate to suit your objectives – request a quote now!

- Easily calculate loan estimates on your property purchase.

- Simply compare rates, compare lenders.

- Secure most competitive rates from 80+ lenders.

Read more...

Get fast repayment estimates to compare property prices, interest rates, lenders and find the most affordable finance option with our easy-use calculation device.

Get figures that are relevant to your purchase and relatable to your budget. No special knowledge of the property lending market or specialised maths skills are required.

Just type in the numbers for your loan and the device does the computation work.

Get your estimates right now and take another step forward to buying your own property.

Simple, User-Friendly Home Loans Calculator – Suits All Buyers!

Trying to select a property to buy based purely on the advertised price guides can be a challenge. Overcome that challenge by quickly changing that price to loan repayment estimates and have a better guide to affordability. Easily compare properties based on repayment estimates for your preferred lending product. Narrow your search, save inspection times, and speed up your property buying process.

Need to set a budget to renovate or build a house with financing? Our device is the ideal resource to make easy work of budgeting. Estimates on repayments for construction loans can be quickly generated using the rates and terms available for those lending options. Simply change the total borrowing amount until the monthly repayment estimate is in your affordability range. Providing an indication of the budget to aim for. Compare quotes from builders, architects and designers based on the loan repayment estimates. Get quick estimates and consult with our experts to find out how we may structure your construction loan to best suit your project and payment schedule.

An astute investment in property can rely heavily on securing the most affordable finance. Investors can compare their options by quickly estimating loan repayments on specific borrowings and specific properties to assess against the rental return. Investment property finance rates vary from owner-occupier rates so ensure the relevant rate is entered when calculating estimates. Approvals for investment mortgages may be approved with 10% deposit – use this indication when entering the borrowing total. Quickly obtain relevant figures to assist your property investment decisions – get estimates now.

For buyers that do not have the required 20% house loan deposit, opportunities may be available for a low deposit loan. Mortgages can be approved by some lenders, subject to buyers meeting the guidelines, with a 5% to 10% deposit. With a higher loan-to-value ratio, these mortgages can attract higher rates than a 20% deposit loan and may also attract Lender Mortgage Insurance costs. Use the calculation device to obtain estimates and consider if this option suits your purposes. For professional advice, guidance and sourcing your most affordable loan, book a mortgage consultation with one of our brokers.

Refinancing is a prospect that most mortgage holders will need to face during the term of their loan. To assist with making decisions around switching or staying and changing rates and loan products, use the device to calculate estimates to compare. The device is also applicable to working up estimates on Home Equity Loans – using collateral in the property as the deposit. For expert assistance in sourcing the most suitable refinancing option for your requirements, connect with our brokers online or by phone.

Quickly Change a Property Price to Loan Estimate

Trying to select a property to buy based purely on the advertised price guides can be a challenge. Overcome that challenge by quickly changing that price to loan repayment estimates and have a better guide to affordability. Easily compare properties based on repayment estimates for your preferred lending product. Narrow your search, save inspection times, and speed up your property buying process.

Make Renovating & Building Budgeting Easier

Need to set a budget to renovate or build a house with financing? Our device is the ideal resource to make easy work of budgeting. Estimates on repayments for construction loans can be quickly generated using the rates and terms available for those lending options. Simply change the total borrowing amount until the monthly repayment estimate is in your affordability range. Providing an indication of the budget to aim for. Compare quotes from builders, architects and designers based on the loan repayment estimates. Get quick estimates and consult with our experts to find out how we may structure your construction loan to best suit your project and payment schedule.

Obtain Useable Figures to Evaluate Property Investments

An astute investment in property can rely heavily on securing the most affordable finance. Investors can compare their options by quickly estimating loan repayments on specific borrowings and specific properties to assess against the rental return. Investment property finance rates vary from owner-occupier rates so ensure the relevant rate is entered when calculating estimates. Approvals for investment mortgages may be approved with 10% deposit – use this indication when entering the borrowing total. Quickly obtain relevant figures to assist your property investment decisions – get estimates now.

Consider Low Deposit Mortgage Options

For buyers that do not have the required 20% house loan deposit, opportunities may be available for a low deposit loan. Mortgages can be approved by some lenders, subject to buyers meeting the guidelines, with a 5% to 10% deposit. With a higher loan-to-value ratio, these mortgages can attract higher rates than a 20% deposit loan and may also attract Lender Mortgage Insurance costs. Use the calculation device to obtain estimates and consider if this option suits your purposes. For professional advice, guidance and sourcing your most affordable loan, book a mortgage consultation with one of our brokers.

Assess Home Equity Loan & Mortgage Refinance Options

Refinancing is a prospect that most mortgage holders will need to face during the term of their loan. To assist with making decisions around switching or staying and changing rates and loan products, use the device to calculate estimates to compare. The device is also applicable to working up estimates on Home Equity Loans – using collateral in the property as the deposit. For expert assistance in sourcing the most suitable refinancing option for your requirements, connect with our brokers online or by phone.

Get Workable, Practical Estimates Quickly – Use Our Home Loans Calculator

- Compare properties based on mortgage payment estimates.

- Estimate all types of property finance options.

- Calculate estimates based on fixed and variable rates.

- Obtain figures to assess and evaluate your options.

- Generate loan estimates for your specific purchase.

Get Mortgage Estimates in Seconds with Our Home Loans Calculator

Getting estimates using our calculation device is extremely fast and extremely easy. We’ve incorporated the latest technology into the formatting to ensure users obtain reliable figures to guide their decisions.

The device is formatted in line with online forms and only 3 figures need to be entered to get the estimates you want. Enter the amount required for the borrowing or property prices if wanting quick comparisons. Select the interest rate and relevant term for that rate, for the preferred lending product. The device completes the complex interest computations to quickly display the monthly repayment estimate based on those entries.

To compare another property, another deposit option, another rate – simply change the entries to reflect those figures. The device is free-to-use and carries no obligation to proceed further should you choose not to. Start estimating your property loan requirements now!

- Simple online formatting for easy operation.

- Flexibility to enter choice of rates, borrowing amounts.

- Convenient, user-friendly – reliable results.

Follow-up Home Loans Calculator Estimates with Specialist Broker Services

The Australian property finance market is vast with thousands of lending products available and variations with loan features, rates and approval criteria. Our specialist mortgage broker services are available to assist all buyers to find the most suitable loan product and the most competitive rates to suit their profile and property purchase.

Our brokers provide professional guidance and advice to clarify what can be complex details and options. We handle the process of selecting the most suitable lender and lending product and contacting lenders to secure the most affordable rates and workable terms and conditions.

Using our services is a straightforward move with no referral required. Our streamlined application procedures assist buyers to more easily and quickly obtain their financing options. Applications can be made in advance of purchase to confirm borrowing capacity and provide buying confidence.

For the support of experts in your property purchase, book a mortgage consultation or request a quote.

Most Frequently Asked Questions About Mortgages

Does a home loans calculator work out first-home buyer loan estimates?

Online calculators work on the figures that are entered by the user. First-home buyers can calculate estimates by entering the borrowing amount, rate and term relevant to their choice of lending product. The estimates generated are to be used as a guide only and a quote from a lender is required to confirm the rate and borrowing capacity for individual borrowers.

What is involved with Lender Mortgage Insurance?

Lender Mortgage Insurance is a policy taken out by lenders to insure against a borrower defaulting on their loan commitments. Lenders typically take out these policies on mortgages with low deposits. The lender arranges the policy but the cost is added to the lender fees charged to the borrower.

What deposit is needed to get a home loan?

A 20% deposit is the lending industry standard for owner-occupier mortgages. Where a borrower does not have 20%, some lenders will approve applications with deposits in the range of 5-10%. A higher interest rate and LMI can apply to low deposit loans. Investment property finance may be approved with 10% and construction loans may also attract varying deposit requirements.

What does a mortgage broker do?

A mortgage broker acts on behalf of those seeking property finance to liaise and negotiate with lenders to source the most suitable lending solution. A broker guides and advises borrowers on the available lending products that suit their specific requirements. Brokers typically assist borrowers with their application and essentially handle the entire loan sourcing, structuring and approval process.

What are the finance options for building a house?

Finance to cover the expenses of building a house are available through Construction Loans. These loans have features which are specifically included to suit the requirements of building projects. The loan may be structured with a drawdown account where the borrower has access to funds to pay invoices as issued by contractors. Alternatively, the loan may be arranged in sync with the progress payment schedule as required by the main builder.

What is the significance of the loan-to-value ratio?

The loan-to-value ratio, LVR, is significant to the interest rate and lender costs associated with a loan. The figure is usually represented as a percentage of the amount the borrower is borrowing compared with the price or the value of the property being financed. The deposit paid affects the LVR. Where the LVR is high with lower deposits, this can represent a higher risk loan to lenders and attract a higher rate and LMI costs.

Can I find out how much I’m approved to borrow before I select a property to buy?

Yes. Property buyers can apply for financing to establish their borrowing capacity prior to purchasing. The borrowing capacity may also be established through a mortgage consultation with a broker. Any conditional approval offer on pre-approved finance is valid for a set timeframe and subject to change when the purchase is made.

What interest rate do I enter when using a home loans calculator?

When using an online loan calculation device, users can input the interest rate which corresponds to their preferred lending product. Rates vary for owner-occupier compared with investor finance, for fixed and variable rate products, and with different deposit levels.

What is a construction loan?

A construction loan is a specific lending product to finance the costs associated with major renovations and with building a house. This type of loan may also suit buyers of house and land packages.

Let Yes Home Loans simplify the process by taking care of the complicated steps for you